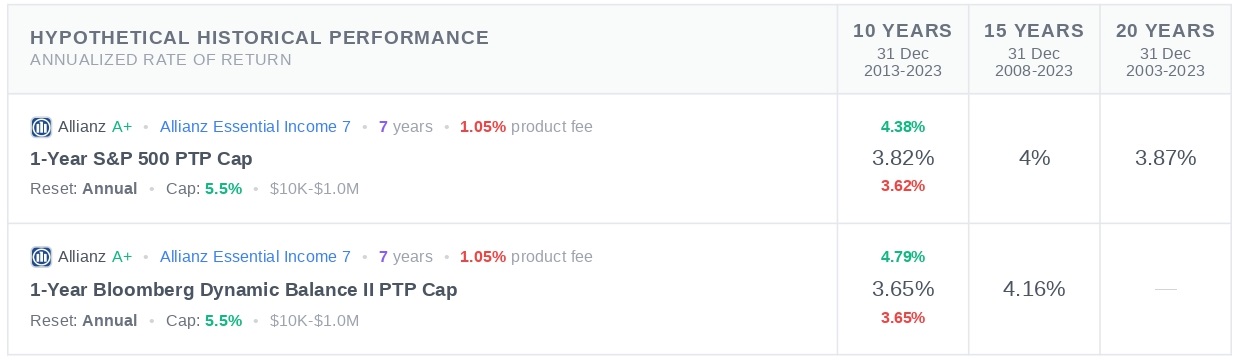

Allianz Essential Income 7 Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

There’s a charge that applies annually, and it's a percentage of the accumulation value, deducted monthly. For the guaranteed minimum value, it’s consistently 1.05% across all contract years. The charge for the accumulation value starts at 1.05% in the first year and can go up to a maximum of 2.50% during the next six years, then settles back to 1.05%.

Index Options

The Allianz Essential Income 7 Annuity offers the following two index options to choose from, each designed to meet different investment strategies and goals.

-

S&P 500® Index

-

Bloomberg US Dynamic Balance II Index

-

Fixed Interest

Crediting Methods

This annuity uses the annual point-to-point with a cap crediting method. This formula measures the change in an index from the start to the end of the annual contract term, applying a cap which is the maximum rate of return that can be credited to the annuity, regardless of how much the index actually increases.

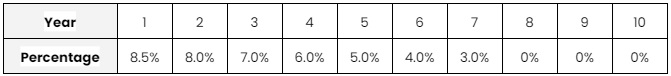

Allianz Essential Income 7 Surrender Charge Schedule

The Allianz Essential Income 7 Annuity includes a surrender charge schedule, which applies if funds are withdrawn in excess of the free withdrawal amount before the end of a specified period.

These charges decrease annually and are designed to discourage early withdrawals, helping to ensure that the funds remain invested for a longer period to potentially increase their value over time.

The schedule typically starts with a higher percentage in the first year and decreases each year until it reaches zero, providing more flexibility as you move closer to the end of the surrender charge period.

Here’s a table showing the surrender charge penalties for early withdrawals from the Allianz Essential Income 7 Annuity.

Allianz Essential Income 7 Annuity Key Features

Allianz essential income 7 has the following key features:

Fixed Index Annuity

The Allianz Essential Income 7 is commonly structured as a fixed index annuity. This means it offers a balance between potential growth based on the performance of an external index (like the S&P 500) and the security of a fixed annuity. Your principal investment is protected from market downturns but has the opportunity to grow based on preset crediting methods linked to an index's performance.

Guaranteed Income

Annuities from reputable companies like Allianz often come with a feature that allows for income to be guaranteed for life. This is an attractive feature for retirees seeking the security of a stable, predictable income stream to cover essential expenses after they stop working.

Income Withdrawal Benefits

The income withdrawal benefits typically allow policyholders to take out a percentage of their annuity's value each year, starting at a certain age, without surrender charge. This feature can be essential for individuals looking to maintain a consistent income.

Bonus on Premium

Some annuities offer a premium bonus, which is essentially an immediate increase to your annuity value. For example, with Allianz Essential Income 7, a certain percentage bonus is usually added to your contract value for every premium payment you make.

Accumulation Potential

The accumulation potential may vary based on the performance of the index to which the annuity is linked. There’s a possibility to increase the contract value through index-linked interest crediting methods, although they are usually capped to control the risk.

Surrender Period

This annuity is likely to have a surrender period of about seven years, as suggested by its name. This means that withdrawals above a certain free-withdrawal amount during this period will incur surrender charges and potentially a market value adjustment.

Pros and Cons

-

Guarantees a steady and predictable income stream, which is particularly valuable for retirees looking for financial stability.

-

The annual withdrawal percentage increases automatically, which can help income keep pace with inflation and rising costs over time.

-

Interest grows tax-deferred, which can enhance the efficiency of long-term growth.

-

Interest grows tax-deferred, which can enhance the efficiency of long-term growth

-

The principal investment is protected against market downturns, providing a secure financial base regardless of market volatility..

-

While there is potential for growth tied to a stock index, the growth is capped, meaning it might not perform as well as the market in strong years.

-

Fees associated with the annuity can be complex and may include administrative fees, mortality and expense risk charges, and optional rider costs.

-

Early withdrawal from the annuity can result in high surrender charges, reducing the accessible value in the initial years.

-

Compared to other financial instruments, annuities generally offer less liquidity, which can be a disadvantage if financial circumstances change unexpectedly.

Key Takeaways

The Allianz Essential Income 7 Annuity offers a secure and robust solution for those seeking reliable financial support in retirement.

With features like the Essential Income Benefit, which increases withdrawal percentages over time, and tax-deferred growth potential, this annuity caters to retirees looking to preserve their lifestyle while protecting their capital from market fluctuations.

Its blend of guaranteed income and growth opportunities, alongside flexibility in withdrawal options, makes it an attractive choice for those aiming to balance stability with potential returns on their investments.

For anyone planning their retirement finances, the Allianz Essential Income 7 Annuity is worth considering for its comprehensive benefits and security.

Company information

Company Name

Allianz Life of North America

Website

Phone Number

800-950-1962

A.M. Best Rating

A+ (superior)

Moody’s Best Rating

Aa3 (fourth-highest)

S&P'S BEST RATING

AA (very strong)

About the Product

Product Name

Allianz Essential Income 7 Annuity

Product Type

Fixed Indexed Annuity

Launch Date

2014

Product Information

The Allianz Essential Income 7 Annuity is a fixed index annuity designed to provide financial stability in retirement through guaranteed lifetime income options and tax-deferred growth.

It features an Essential Income Benefit that automatically increases withdrawal percentages with age, helping retirees manage rising living costs. This product is ideal for those seeking a secure and predictable income stream, alongside the potential for growth linked to a stock market index, while protecting the principal from market downturns.

Account Types

Non-Qualified, 401k, IRA, Spousal IRA, IRA Rollover, IRA Transfer, SEP IRA, IRA-Roth, and TSP

Not Available In

New York