Fees and Charges

The Lifetime Income Plus Flex rider costs 1.10% annually. Besides that, this General Power Select Plus Income annuity doesn’t charge any additional fees.

Index Options

Power Select Plus Income - Lifetime Income Plus Flex allows you to take advantage of numerous indexing opportunities, including:

- 1-Year Russell 2000 PTP

- 1-Year AB All Market PTP

- 2-Year AB All Market PTP

- 1-Year Dimensional US Foundations PTP

- 2-Year Dimensional US Foundations PTP

- 1-Year S&P 500 PTP

- 1-Year PIMCO Global Optima PTP

- 1-Year ML Strategic Balanced PTP

- 2-Year ML Strategic Balanced PTP

- 2-Year PIMCO Global Optima PTP

- 2-Year S&P 500 PTP

- 1-Year S&P 500 Performance Triggered

Crediting Methods

When it comes to crediting methods, your assets can grow depending on the following available index interest accounts:

-

Fixed: Provides a guaranteed interest rate for a specified period, ensuring predictable returns.

-

PTP Annual: Point-to-Point Annual credits interest based on the performance of an index measured annually from the start to the end of the contract year.

-

PTP Biennial: Point-to-Point Bilennial credits interest based on the performance of an index measured over a two-year period from the start to the end of the biennial period.

-

Performance Triggered: Credits interest if the chosen index meets or exceeds a specified performance threshold during the contract period.

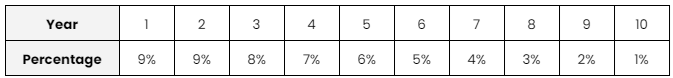

Annuity Surrender Charge Schedule

Lifetime Income Plus Flex comes with a 10-year annuity surrender charge schedule. It means that if you decide to withdraw your funds earlier than stated in the contract, you will be charged a fee called the surrender charge, which is a percentage of your withdrawal amount that gradually decreases annually.

Lifetime Income Plus Flex Features

Lifetime Income Plus Flex Rider

- This rider provides an income stream for life, with the flexibility to adjust your income amount in the future.

- The Lifetime Income Plux Flex rider costs 1.10% annually.

- It offers the flexibility to take withdrawals prior to activating the rider, the ability to change the number of individuals protected by the rider, and the opportunity to increase your income with the Enhanced Income Benefit.

Waivers

- The annuity offers its annuitants three possible waivers - Terminal Illness, Nursing Home, and Extended Care waiver.

- The Nursing Home waiver is available in all states where this annuity can be purchased. The Terminal Illness waiver isn’t available in CA, MA, and WA, whereas the Extended Care waiver isn’t available in CA and MA.

Power Select Plus Income - Lifetime Income Plus Flex Pros & Cons

-

Has the potential to earn higher returns than traditional fixed annuities.

-

The Lifetime Income Plus Flex rider provides a steady income stream for life.

-

You can adjust your income amount in the future to meet your changing needs.

-

No additional fees besides the Lifetime Income Plus Flex rider.

-

Numerous index and crediting options.

-

Available in most states.

-

A 10-year surrender schedule isn’t overly beneficial to the annuitant.

-

The $25,000 minimum premium is quite high.

-

MVA not applicable in all states.

Company information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P'S BEST RATING

A+ (middle of the investment grade)

About the Product

Product Name

Power Select Plus Income - Lifetime Income Plus Flex

Product Type

Fixed Indexed Annuity

Product Information

Power Select Plus Income - Lifetime Income Plus Flex is a versatile financial product designed to provide a steady income stream for life with added flexibility.

It features the Lifetime Income Plus Flex option, which allows your Income Base to grow by 8.5% annually before lifetime withdrawals begin. This product offers various crediting options, such as fixed-interest and index-based strategies, ensuring diverse growth opportunities.

Account Types

Non-Qualified, IRA, Spousal IRA, IRA Rollover, IRA Transfer, SEP IRA, IRA-Roth, and TSP

Available In

AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, HI, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, and WY