Nationwide New Heights Select 9 Historical Rate of Return

Fees and Charges

One of the Nationwide New Heights Select 9 benefits is that there are no charges or fees unless you withdraw more than the allowed amount.

Index Options

Nationwide New Heights Select 9 can help you diversify your investment portfolio with six different indexes:

The Goldman Sachs New Horizons Index splits investments between traditional global assets and alternative strategies to spread risk and potentially boost returns.

The J.P. Morgan Mozaic II℠ Index picks the top-performing global assets each month and adjusts your investments to create smoother, more reliable returns.

The NYSE® Zebra Edge® II Index chooses the best stocks from top U.S. companies, combines them with safe assets like government bonds, and aims for consistent growth with less risk.

The SG Macro Compass Index adjusts its investments based on global economic predictions, reallocating funds to keep pace with changing markets for steady growth and diversification.

The S&P 500® Index tracks the performance of 500 of the biggest U.S. companies, offering a snapshot of the overall U.S. economy.

The MSCI EAFE Index represents stocks from major developed countries outside the U.S. and Canada, providing a way to invest globally in developed markets.

Crediting Methods

Nationwide New Heights Select 9 utilizes the Balanced Allocation Strategy (BAS) to calculate your earnings. This approach combines various elements like indexes, declared rates, and strategies to determine your returns. With this annuity, you can choose up to ten different options to allocate at any point during the contract.

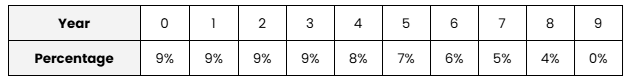

Nationwide New Heights Select 9 Surrender Schedule

Like other annuities, Nationwide New Heights Select 9 imposes surrender charges throughout the entire contract term. Below is a detailed breakdown of the penalties you may incur for each year:

*The interest rate may vary depending on the state.

The specific surrender charge percentages differ by state. In California, the charges begin at 8.15% and decrease annually. In other states like Alaska, Connecticut, Delaware, Iowa, and others, the rate starts at 9% in the first year, 8.9% in the second year, and continues to reduce each year.

Nationwide New Heights Select 9 Key Features

Nationwide New Heights Select 9 advantages include:

Protection from Market Risk

- Nationwide ensures that your initial investment and any credited earnings are protected, even if the indexes you select underperform.

Deferral of Taxes

- With Nationwide New Heights Select 9, your value will grow tax-deferred. Moreover, you can also delay paying taxes up until the moment you start taking withdrawals.

Lock-in Feature

- You can lock in the value of your selected strategies at any point, ensuring that this value is used to calculate your earnings, even if the market changes later. This lock-in also protects your withdrawal amounts or death benefits.

Daily Accumulation Value (DAV)

- The DAV keeps track of how your investments are doing every day and ensures that your account will always reflect either your strategy’s earnings or a guaranteed return on what you initially invested, whichever is greater.

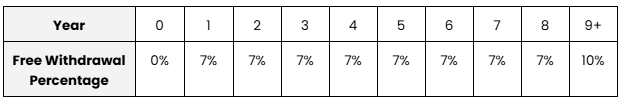

Free Withdrawals

- With the Nationwide New Heights Select 9, you will be able to withdraw a small portion of your funds before the end of your contract’s term. If you withdraw a permitted amount of money, you may be exempt from surrender charges and Market Value Adjustments.

Nationwide New Heights Select 9 Pros and Cons

-

No extra charges

-

RMD-friendly

-

Death benefit and terminal illness waivers available

-

Spouse protection

-

Free withdrawals

-

Lock-in feature

-

High minimum investment ($25,000)

-

Long surrender charges

-

Single premium without the possibility to add more money later

Company Information

Company Name

Nationwide

Website

https://www.nationwide.com/

Phone Number

1-877-669-6877

A.M. Best Rating

A+ (Excellent)

S&P’s Best Rating

A+ (Strong)

About the Product

Product Name

Nationwide New Heights Select 9

Product Type

Fixed Index Annuity

Product Information

Nationwide New Heights Select 9 is a fixed indexed annuity for a term of 9 years. The annuity offers many beneficial features, like lock-in, DAV, and spouse protection, among others.

With the ability to withdraw money free of penalties and crisis waivers activated after the first year of annuity, you can maximize your savings tax-deferred and a protection from market risk.

Account Types

Traditional IRA, Roth IRA, Non-Qualified,

Charitable Remainder Trusts (CRT), SEP IRA, Simple IRA, and 401(a)

Not Available In

N/A