Assured Edge Income Builder Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

Assured Edge Income Builder includes a rider fee of 0,95% of your account balance, charged annually.

Guaranteed Interest Rate

With the Assured Edge Income Builder annuity, you can grow your investment based on a fixed interest rate on your contributions. This rate is locked in for a specific period at the time you purchase the annuity contract. For this particular annuity product, the interest rate is 2.25%.

Crediting Methods

The Assured Edge Income Builder annuity uses a crediting method that utilizes a mechanism for growing your guaranteed lifetime income benefit (GLIA). Here's a breakdown:

- Initial GLIA: This is calculated at the end of the initial premium payment period (60 days after the contract is issued). It simply multiplies your total contributions by an income percentage based on your age at that time.

- Income Growth Credit: This is a yearly increase applied to your GLIA if you haven't begun receiving lifetime income withdrawals.

Since this is a fixed annuity, there's no involvement of the stock market in this crediting method. The income growth rate is guaranteed by the insurance company.

Once you start receiving lifetime income, the guaranteed income amount (GLIA) is locked in and won't grow further with annual increases.

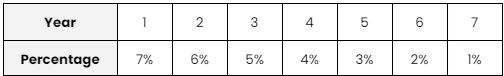

Assured Edge Income Builder Annuity Surrender Charge Schedule

Assured Edge Income Builder Key Features

Guaranteed Lifetime Withdrawal Benefit

This benefit provides you with a stream of income for life once you start receiving withdrawals. The GLIA is calculated based on your initial contributions and an income percentage tied to your age at that time.

Market Value Adjustment (MVA)

Early withdrawals may be subject to a Market Value Adjustment (MVA). This applies to withdrawals exceeding the penalty-free amount during the first five years of your contract.

For this annuity product, MVA will not be applied to:

- Withdrawals up to the guaranteed lifetime income amount (GLIA) after income payments begin.

- Penalty-free withdrawals, including those allowed at age 59 ½.

- Death benefit payout.

- Converting your annuity into income payments (annuitization).

- Required Minimum Distributions (RMDs) mandated by the IRS.

- The minimum withdrawal amount allowed by the contract.

Death Benefit

The death benefit on the Assured Edge Income Builder acts as a safety net for your beneficiaries. If you pass away before starting to receive income withdrawals, the death benefit ensures your beneficiaries receive a lump sum. This can help cover expenses or provide financial support during a difficult time.

Pros and Cons

-

Guaranteed Lifetime Withdrawal Benefit

-

Predictable growth that is not tied to stock market fluctuations

-

Top Rated Carrier

-

RMD Friendly

-

Death Benefit included

-

Lower growth potential (since it’s a fixed annuity)

-

7-year term (could be considered a con)

-

Potential MVAs on withdrawals

Key Takeaways

The Assured Edge Income Builder annuity by Corebridge Financial is a fixed annuity designed for those nearing retirement who prioritize lifetime income and predictable growth with some protection from market risk.

Those who understand and are comfortable with the limitations of fixed annuities, such as lower growth potential and surrender charges, can greatly benefit from this annuity product.

Through the Guaranteed Lifetime Withdrawal Benefit, you receive a steady stream of income for life after you start withdrawals. This can provide financial security and peace of mind in retirement.

Company information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P'S BEST RATING

A+ (middle of the investment grade)

About the Product

Product Name

Assured Edge Income Builder

Product Type

Fixed Annuity

Launch Date

2016

Product Information

Assured Edge Income Builder is a fixed annuity which is a type of contract that offers a fixed interest rate on your contributions. This rate is locked in for a specific period at the time you purchase the annuity contract.

The earnings on your contributions accumulate on a tax-deferred basis. This means you don't pay taxes on the interest earned until you start withdrawing money from the annuity, which can be beneficial for growing your retirement savings.

Account Types

Personal Single or Joint, Non-Qualified, 401k, IRA, IRA Rollover, IRA Transfer, TSA 403b, SEP IRA, KEOGH, IRA-Roth, 1035 Exchange, and TSP

Not Available In

Refer to the contract