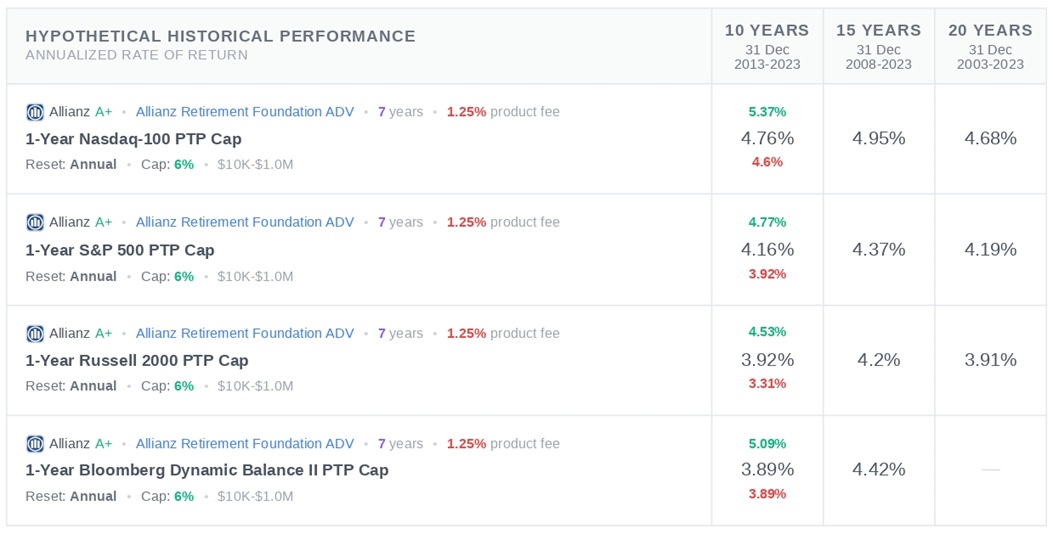

Allianz Retirement Foundation Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

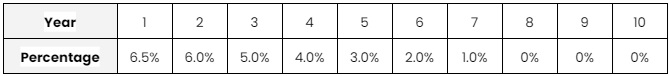

The Allianz Retirement Foundation ADV Annuity includes a few key fees and charges: an annual benefit charge of about 1.25% of the contract's accumulation value, and surrender charges if funds are withdrawn early.

These surrender charges start at 6.5% in the first year and taper off to 0% by the eighth year. Distributions from the annuity may also be subject to withdrawal charges and market value adjustments (MVAs).

Additionally, withdrawals are taxed as ordinary income, and, if taken before age 59½, they may incur a 10% federal additional tax.

Index Options

This annuity provides a choice of several index options to align with your financial goals, and these include:

-

S&P 500 Index

-

NASDAQ-100 Index

-

Russell 2000 Index

-

Bloomberg US Dynamic Balance Index II

-

Fixed Interest

Crediting Methods

The Allianz Retirement Foundation ADV annuity offers two primary crediting methods to calculate the growth on your investment:

-

Annual Point-to-Point with Cap: This method tracks the change in the index from the beginning to the end of the policy year. It includes a cap, which is the maximum rate of return that can be credited to your annuity for that year, regardless of how much the index actually increases.

-

2-Year or 5-Year MY Point-to-Point with a Participation Rate: This method involves a longer-term evaluation of index performance, either over two or five years. It uses a participation rate, which determines what percentage of the index increase is used to calculate your credited interest.

Allianz Retirement Foundation Surrender Charge Schedule

Allianz Retirement Foundation Key Features

The Allianz Retirement Foundation ADV annuity offers a range of features tailored to support flexible and secure retirement planning, and they include:

Flexible-Premium Deferred Index Annuity

This feature allows you to make contributions to your annuity during the initial three years of the policy, providing flexibility in how and when you fund your retirement savings.

Income Benefit Rider

The Income Benefit Rider enhances the annuity by offering increasing lifetime withdrawal percentages annually until withdrawals begin. This guarantees a stable income for life, with several options tailored to your financial needs.

Joint Life Option

This option is available for both single and joint life setups. It is particularly beneficial for couples, as it provides annual payout percentage increases starting at age 45, helping to keep pace with the cost of living and inflation.

Nursing Home Benefit

If the need arises for nursing home care, this benefit kicks in to help manage the increased expenses. Typically, if you're confined to a nursing home for a certain number of consecutive days (typically at least 90 days), the annuity may offer increased income payments or fee waivers to help cover these costs.

Flexible Annuity Option Rider

The Flexible Annuity Option Rider adds a layer of adaptability to your annuity payouts. This option allows you to modify your income stream as your financial needs evolve over time, offering a way to customize how and when you receive your funds according to your personal financial plan.

Pros and Cons

-

Allows contributions during the first 3 years

-

Offers several index options and fixed accounts to suit different risk tolerances

-

Provides increasing lifetime withdrawal percentages, ensuring income for life

-

Offers benefits like increased payouts if confined to a nursing home and flexible withdrawal options

-

Earnings grow tax-deferred until they are withdrawn, providing a tax advantage

-

Imposes fees for early withdrawals, decreasing over a 7-year period

-

Charges for optional benefits like the Income Benefit Rider

-

Can be complex for some users to understand all terms and options available

-

MVAs can decrease the amount received during withdrawals if market conditions are unfavorable

-

Requires a minimum initial investment of $10,000, which might be high for some

Key Takeaways

The Allianz Retirement Foundation annuity offers a thoughtful mix of flexibility, security, and growth potential, making it a compelling choice for retirees.

Its structured benefits, like the Income Benefit Rider, and various investment options cater to a wide array of financial needs and preferences, ensuring that each retiree can find a fit that supports their vision for the golden years.

So, if you're looking for a reliable tool to help secure your financial future in retirement, this annuity merits serious consideration.

Company information

Company Name

Allianz Life of North America

Website

Phone Number

800-950-1962

A.M. Best Rating

A+ (superior)

Moody’s Best Rating

Aa3 (fourth-highest)

S&P'S BEST RATING

AA (very strong)

About the Product

Product Name

Allianz Retirement Foundation Review

Product Type

Fixed-index

Launch Date

2017

Product Information

The Allianz Retirement Foundation annuity is a flexible premium deferred index annuity that allows contributions during the first three policy years. It offers a variety of investment options, including multiple indices and fixed accounts, tailored to different risk tolerances.

Key features include an Income Benefit Rider that increases withdrawal percentages each year until withdrawals begin, ensuring a steady income stream for life. The plan also includes a 7-year surrender charge period with a Market Value Adjustment provision and requires a minimum investment of $10,000. This annuity is designed for individuals looking for growth potential with the benefit of tax-deferred earnings and options for lifetime income.

Account Types

Non-qualified account, 401k, profit sharing, IRA, pension, IRA rollover, 401a, IRA transfer, SEP IRA, KEOGH, IRA-Roth, and TSP

Not Available In

New York