Nationwide Peak 10 Historical Rate of Return

Fees and Charges

One of the Nationwide New Heights Select 10 benefits is the lack of extra fees and charges. However, you should be aware of penalties, such as surrender charges, which we will discuss further in this review.

Index Options

One of the biggest Nationwide New Heights Select 10 advantages is its portfolio diversifying opportunities because this annuity offers 6 different indexes. Here is a brief information on each of them:

The Goldman Sachs New Horizons Index combines global investments with alternative strategies to improve diversification and boost potential returns.

The J.P. Morgan Mozaic II℠ Index looks at 15 different global asset types each month, choosing the 9 best performers from the past six months to create more steady and consistent returns.

The NYSE® Zebra Edge® II Index selects stocks from the 500 biggest U.S. companies using behavioral finance research. It mixes these stocks with bonds and cash to lower risk and provide steady long-term returns.

The SG Macro Compass Index adjusts its investments based on expected changes in the economy and inflation, aiming to provide stable growth and diversification even when markets change.

The S&P 500® Index is a key measure of the U.S. economy, tracking 500 of the largest U.S. companies. It’s one of the most widely followed stock indexes.

The MSCI EAFE Index focuses on stocks from developed countries outside of North America, including Europe, Australasia, and the Far East, offering global diversification.

Crediting Methods

Nationwide New Heights Select 10 uses Balanced Allocation Strategy (BAS) as its earnings crediting methodology. What it means is this is a blend of different components (e.g., Index, declared rate, strategy) that determine your earnings. With this annuity, you can allocate a maximum of ten different options at any time in the contract.

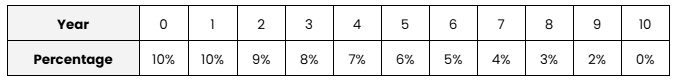

Nationwide New Heights Select 10 Surrender Schedule

Nationwide New Heights Select 10 surrender charges lower each year until they reach zero, and you can withdraw your earnings without penalties. Here is a breakdown of the surrender schedule:

*The interest rate may vary depending on the state.

The percentage rate is different for every state. For example, in California, the surrender charge starts at 8.40%, while in other states (e.g., AK, CT, DE, IA, etc.), the rate begins at 9.2%.

Nationwide New Heights Select 10 Key Features

Nationwide New Heights Select 10 advantages include:

Lock-in Feature

- As a Nationwide New Heights Select 10 annuity holder, you can choose up to ten different strategy options. For each option, you have the ability to lock in the index value before the term ends.

- This locked-in value will then be used to determine the strategy’s earnings at the end of the term. This feature also applies to withdrawals or death benefits.

Daily Accumulation Value (DAV)

- The DAV tracks the daily performance of your selected strategy options. It will always be the higher of either: (1) the contract value plus any uncredited strategy earnings or (2) the guaranteed return on your initial purchase payment.

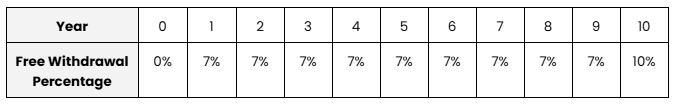

Free Withdrawals

- With the Nationwide New Heights Select 10, you can withdraw funds without facing penalties. These free withdrawals may be exempt from surrender charges and Market Value Adjustments (MVA).

Nationwide New Heights Select 10 Pros and Cons

-

No extra charges

-

RMD-friendly

-

Death benefit and terminal illness waivers available

-

Spouse protection

-

Free withdrawals

-

Lock-in feature

-

High minimum investment ($25,000)

-

Long surrender charges

-

Single premium without the possibility to add more money later

Company Information

Company Name

Nationwide

Website

https://www.nationwide.com/

Phone Number

1-877-669-6877

A.M. Best Rating

A+ (Excellent)

S&P’s Best Rating

A+ (Strong)

About the Product

Product Name

Nationwide New Heights Select 10

Product Type

Fixed Index Annuity

Product Information

The Nationwide New Heights Select 10 annuity is a long-term financial product that offers a blend of growth potential and protection.

It provides multiple indexed strategy options to grow your money while safeguarding your initial investment.

With a 10-year term, it features benefits like a lock-in feature for securing index values, free withdrawals without penalties, and guaranteed returns on your purchase payment.

Account Types

Traditional IRA, Roth IRA, Non-Qualified,

Charitable Remainder Trusts (CRT), SEP IRA, Simple IRA, and 401(a)

Not Available In

N/A